Some Ideas on Estate Planning Attorney You Need To Know

Some Ideas on Estate Planning Attorney You Need To Know

Blog Article

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Table of ContentsIndicators on Estate Planning Attorney You Need To KnowNot known Facts About Estate Planning AttorneyEstate Planning Attorney - Truths9 Simple Techniques For Estate Planning AttorneyA Biased View of Estate Planning Attorney

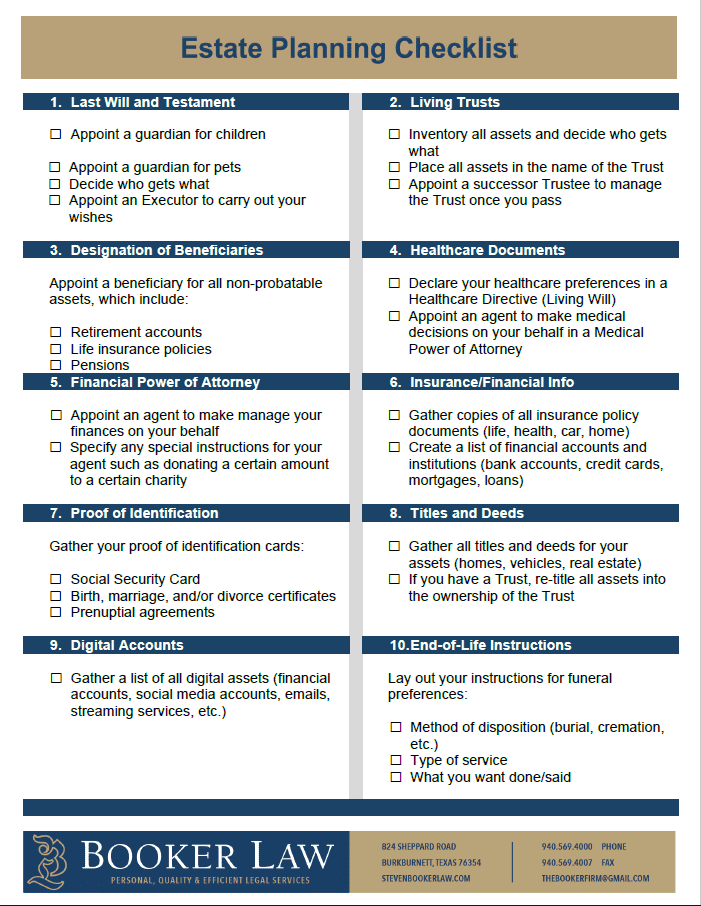

Dealing with end-of-life decisions and protecting family wide range is a tough experience for all. In these tough times, estate planning attorneys aid individuals prepare for the distribution of their estate and develop a will, trust fund, and power of lawyer. Estate Planning Attorney. These attorneys, also described as estate law attorneys or probate lawyers are qualified, seasoned specialists with a comprehensive understanding of the government and state legislations that apply to just how estates are inventoried, valued, dispersed, and taxed after fatality

The intent of estate planning is to appropriately get ready for the future while you're audio and capable. An appropriately prepared estate plan lays out your last dreams specifically as you desire them, in one of the most tax-advantageous way, to prevent any type of questions, mistaken beliefs, misconceptions, or conflicts after death. Estate preparation is a field of expertise in the lawful occupation.

Get This Report on Estate Planning Attorney

These attorneys have an in-depth understanding of the state and government legislations associated with wills and depends on and the probate process. The duties and obligations of the estate attorney might include counseling customers and preparing lawful files for living wills, living trust funds, estate plans, and inheritance tax. If needed, an estate preparation attorney might take part in lawsuits in court of probate in behalf of their customers.

According to the Bureau of Labor Stats, the work of attorneys is anticipated to expand 9% between 2020 and 2030. Regarding 46,000 openings for attorneys are forecasted yearly, on average, over the years. The path to ending up being an estate planning attorney is comparable to other technique areas. To enter into law institution, you must have an undergraduate level and a high GPA.

Preferably, think about possibilities to obtain real-world work experience with mentorships or internships connected to estate planning. Doing so will give you the abilities and experience to gain admission into legislation institution and connect with others. The Regulation School Admissions Test, or LSAT, is a crucial component of applying to law school.

Normally, the LSAT is readily available 4 times each year. It is essential to prepare for the LSAT. Many potential trainees start examining for the LSAT a year ahead of time, usually with a study group or tutor. Many legislation students request legislation institution during the loss semester these details of the final year of their undergraduate researches.

The 7-Minute Rule for Estate Planning Attorney

Generally, the yearly income for an estate attorney in the U.S. is $97,498. Estate Planning Attorney. On the high-end, an estate planning attorney's wage might be $153,000, according to ZipRecruiter. The estimates from Glassdoor are similar. Estate preparing attorneys can work at huge or mid-sized law office her response or branch off on their own with a solo practice.

This code associates with the restrictions and policies troubled wills, counts on, and various other legal documents appropriate to estate preparation. The Uniform Probate Code can vary by state, yet these laws regulate various aspects of estate planning and probates, such as the production of the trust or the lawful legitimacy of wills.

It is a tricky question, and there is no easy answer. You can make some considerations to assist make the decision simpler. When you have a listing, you can tighten down your choices.

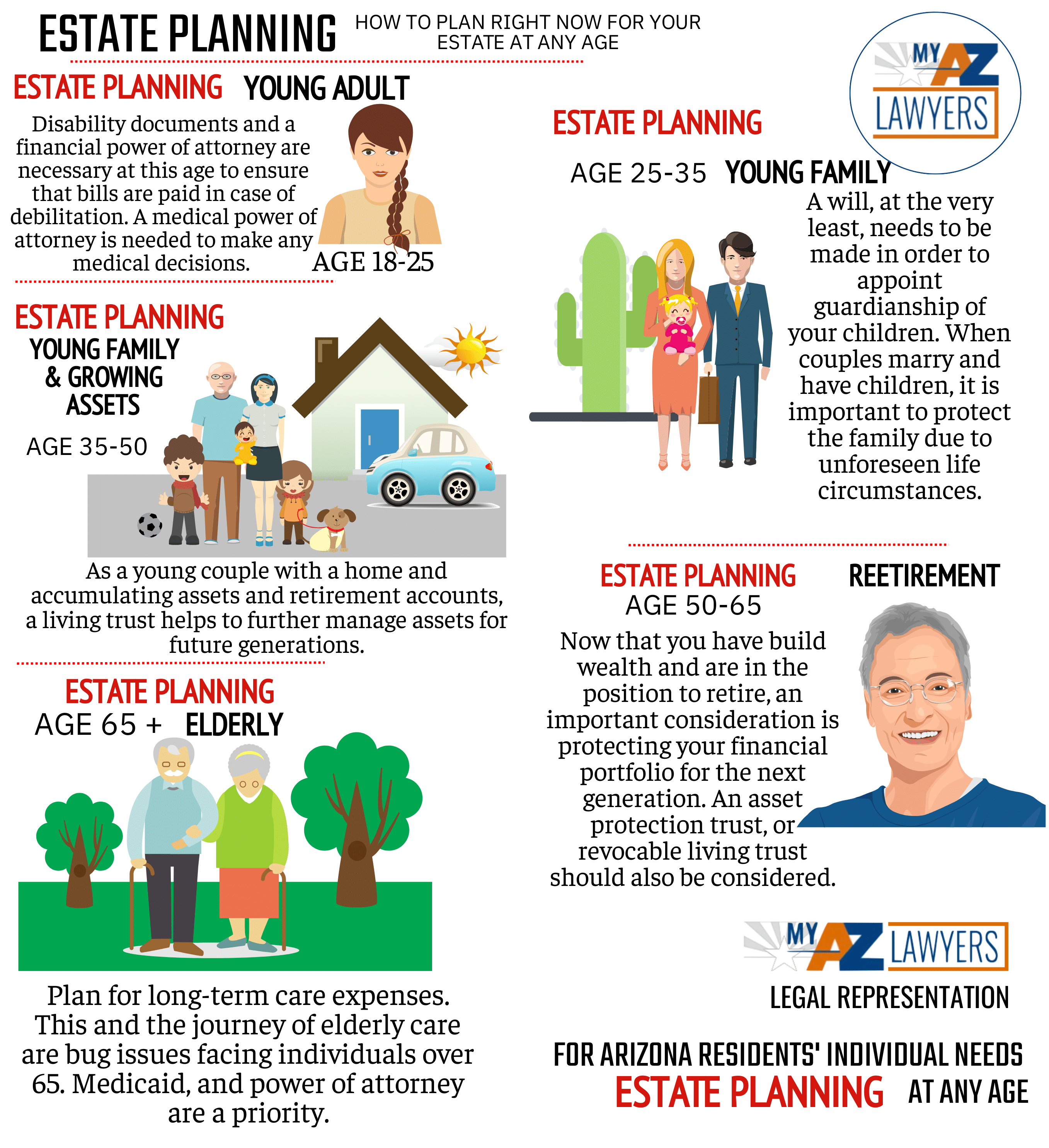

It includes making a decision just how your properties will certainly be dispersed and that will certainly handle your experiences if you can no much longer do so on your own. Estate planning is a needed part of financial my response planning and should be done with the aid of a certified specialist. There are a number of aspects to think about when estate planning, including your age, health, financial situation, and family members scenario.

Indicators on Estate Planning Attorney You Need To Know

If you are young and have couple of belongings, you might not need to do much estate preparation. Wellness: It is a necessary element to take into consideration when estate planning.

If you are wed, you should take into consideration exactly how your properties will be dispersed between your spouse and your beneficiaries. It intends to make sure that your possessions are distributed the means you desire them to be after you pass away. It includes taking into account any taxes that might need to be paid on your estate.

An Unbiased View of Estate Planning Attorney

The attorney also helps the people and family members develop a will. The lawyer likewise aids the people and family members with their depends on.

Report this page